Tuition & Aid

Tuition & Aid

Nightingale College’s Financial Aid Department recognizes that each learner has a unique financial situation. Various financial aid plans are available for qualified learners. To contact the Financial Aid Department, call 801-689-2160 or email financialaid2.x@nightingale.edu.

Receive an estimate of how much learners similar to you paid to attend Nightingale College.

Cost of Attendance

The cost of attendance (COA) for a learner is an estimate of the learner’s educational expenses for the period of enrollment. The period of enrollment can be an academic year and/or a semester depending on a learner’s program schedule. All funding types, whether federal or otherwise (scholarships, private loans, etc.) cannot exceed the COA in any given academic year.

The COA includes the following components: tuition, fees, books, supplies, transportation/travel, housing and food, loan fees, and some personal/miscellaneous expenses. The components of the cost of attendance are in accordance with the Higher Education Act of 1965, section 472. Nightingale College uses institutional historical data to determine average direct costs and the national average for living expenses through Collegeboard.org to calculate the COA.

2025-2026 Cost of Attendance - Graduate Programs

2025-2026 Cost of Attendance - Undergraduate Programs

*Note – Books and supplies are included in the tuition and fees component of the COA and loan fees are included with the personal/miscellaneous expenses.

Cost of Attendance Per Credit*

Tuition for the LPN-to-ASN program is $825 per semester credit.

Tuition for the PN diploma program is $495 per semester credit.

Tuition for the BSN program is $655 per semester credit.

Tuition for the RN-to-BSN track is $655 per semester credit.

Tuition for the MSN Ed program is $460 per semester credit.

Tuition for the MSN FNP program is $550 per semester credit.

Tuition for the MSN PMHNP program is $550 per semester credit.

*Tuition does not include the nonrefundable application fee or any course resources fees. The College reserves the right to change its tuition and fees at any time, with a 30-day notice.

Nightingale College Financial Plan

Download Nightingale College’s 2025-2026 College Financial Plan (previously titled the Shopping Sheet) by clicking the following links:

PN Diploma Program Financial Plan

LPN-to-ASN Program Financial Plan

RN-to-BSN Program Financial Plan

MSN FNP Program Financial Plan

MSN PMHNP Program Financial Plan

*This document is for estimate purposes only and is not a guarantee of receiving any type of aid listed and is provided for personal use only. For an estimated personalized college financial plan, please reach out to the Learner Funding Advising Office at fundingadvising@nightingale.edu.

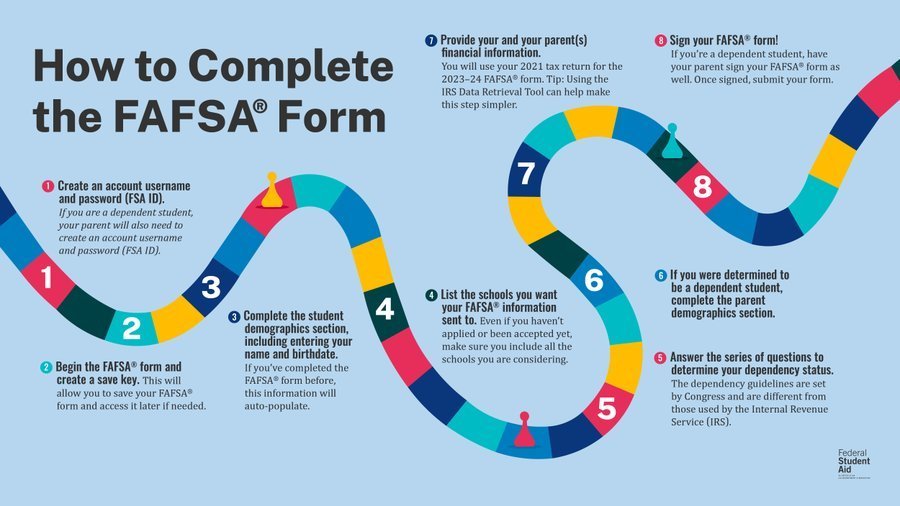

To Begin the Financial Aid Process:

- Submit a free application for Federal Student Aid (FAFSA) by clicking here. You will need to make a FSA ID before filling out the FAFSA by going here.

- View the available scholarships offered by Nightingale College and access additional resources by clicking here.

- Go to the FASTChoice website to compare private student loans.

- View the VA’s benefits available to qualified military servicemembers and veterans by clicking here.

Priority for administrative processing will be given to learners who submit their finalized FAFSA application eight weeks prior to the start of each semester. Learners who submit after this date will still be processed, but processing times may vary depending on the submission date and available resources.

Student Lending Code of Conduct Disclosure

Nightingale College’s code of conduct prohibits a conflict of interest with the responsibilities of an officer, employee, or agent of the institution with respect to Federal Direct Loans or private education loans.

How to Manage Your Student Loans

Resources

Use the Repayment Estimator when you are beginning repayment of your federal student loans for the first time or exploring repayment options based on your income. Click here to get started.

For tips on how to graduate without debt, click here.

GradReady

Find the right tools to help you manage your tuition, budget, and bills by checking out Nightingale College’s exclusive site through GradReady. Access videos, tips, and additional resources to help you pay for college, learn money management, and student-loan repayment.

Click the Start Now! button after going to the site to get started.

Ascendium

We’ve partnered with the people at Ascendium Education Solutions® to help you navigate repayment. They can address any questions or concerns you may have about your federal student loans.

• Available at no cost to you

• Ascendium is a trusted partner

• Use their insight and guidance to make your payments manageable

Ascendium has helped millions of students successfully navigate federal student loan repayment and they can help you too! Their elite squad of success coaches are respectful and can help you find the repayment solution that works best for you.

For additional questions call the financial aid department: (801) 689-2160

Military and Veteran Resources

Contacts for financial aid/VA-certifying officials and the Learner Support Services counselor who specialize in assisting military and veteran learners:

Financial Aid/VA-Certifying Officials

Please contact vaprocessing@nightingale.edu or call reception at 801-689-2160 for the following assistance:

- Payments

- Completion of Forms

- General Questions

- Invoicing

Learner Support Services Counselor

Please contact militarylss@nightingale.edu or call reception at 801-689-2160 for the following assistance:

- Academic Counseling

- Financial Aid Counseling

- Job Search Support

- Other Student Support Services

*Note: The Department of Defense and the Department of the Army are neither affiliated with nor endorse Nightingale College.

Consumer Disclosure Information

View Annual Nursing Program Disclosure

View Consumer Disclosure Information